What Is Deductible In Health Insurance With Example India

In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. Yes, coronavirus health insurance comes out with a waiting period of 15 to 30 days from the date of commencement of the policy.

Insurance Quotation Template Quotation Format Quote Template Quotations

If your health insurance claim amount is rs.

What is deductible in health insurance with example india. For example, if you have a $2,000 deductible and spend that much on healthcare during the year, your insurance will start paying for a portion of. Deduction in respect of medical insurance premium [section 80d] as per section 80d, an individual or a huf can claim deduction in respect of the following payments: Moreover, if you already have a regular health insurance plan, then you don't have to serve any waiting period under the same.

In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments. 10,000 and the health care claim is of rs. 1,00,000 is paid by the health insurance company.

Your insurance company pays the rest. Your deductible is the amount you pay for health care out of pocket before your health insurance kicks in. Unlike auto, renters, or homeowners insurance, where you don’t get services until you pay your deductible.

A health insurance deductible is a set amount of money that an insured person must pay out of pocket every. The amount you pay for covered health care services before your insurance plan starts to pay. Your deductible resets every year, even if your expenses exceeded it the previous year.

Hence, it is advisable to check with your insurance company regarding any initial waiting period. This is a certain amount that you have to pay towards your medical bills before your policy kicks into action. 1) medical insurance premium paid by assessee, being individual/huf by any mode other than cash.

With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself. Deductible is the amount that a policy holder has to pay before the insurance company starts paying up. A health insurance deductible is the amount a consumer has to pay for covered services or medications before their insurance plan starts to pay.

What do you mean by deductibles in health insurance? Insurance companies negotiate their rates with providers and you’ll pay that discounted rate. People without insurance pay, on average, twice as much for care.

What is a health insurance deductible? 10,000 will be paid from your pocket because it is your policy plan’s deductible amount. If you’ve opted for a top up plan with a deductible of 5 lakhs and during the year, you have two claims of 4 lakhs each, then your top up health insurance won’t cover for the claim since the single claim doesn’t cross 5 lakhs.

Obviously, this is a smart move and includes the following benefits: To understand the term better, here is an example of how deductibles in health insurance in india work: In other words, the insurance company is liable to pay the claim amount only when it exceeds the deductible.

50,000, then you pay rs. Both voluntary deductible and copay are different terms. 1,50,000 and your policy’s deductible amount is rs.

An aggregate deductible is often part of product liability policies or family health insurance policies, and any other policies that might result in a large number of claims during a specific period. Deductibles are typically used to deter the large number of claims that a consumer can be reasonably. What is deductible in health insurance with example?

A deductible is a component of cost sharing. After you pay your deductible, you usually pay only a copayment or coinsurance for covered services. Unlike in car or home insurance where the deductible is paid per claim, the deductible.

Deductibles are a form of cost sharing; Deductibles are a fixed amount of money that you have to pay before your policy kicks in to take charge of your medical treatment. Covered medical expenses are added to or accumulated toward a deductible over.

A health insurance deductible is different from other types of deductibles. Typically, a lower deductible will result in. For instance, your comprehensive deductible will be applicable if your car incurs damages due to fallen tree branches after a typhoon.

So a health plan cannot have, for example, a $10,000 aggregate deductible. If the deductible of your policy is rs 30,000 and the claim by the insured is rs 40,000, then the insurance company is liable to pay only. Health insurance deductibles apply on an annual basis, which means your deductible will reset when your policy renews.

The insurers splits the cost of care with you. 50,000 while the balance amount of rs. It is generally expressed in percentage terms.

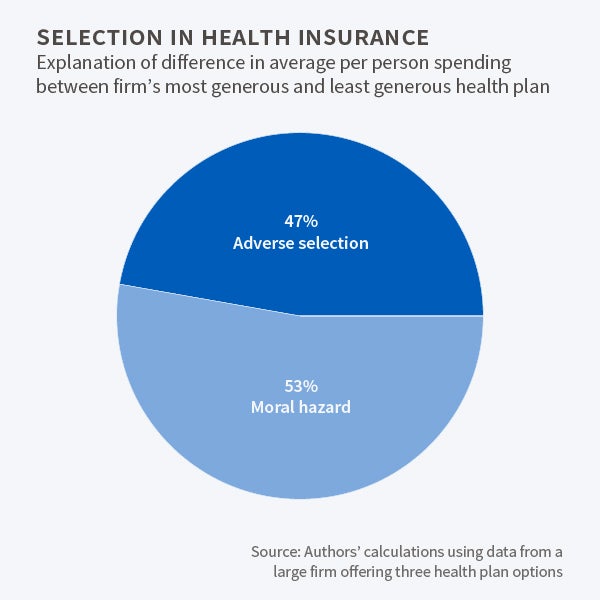

Moral Hazard And Adverse Selection In Health Insurance Nber

Example Of Power Of Attorney Form Importantdocuments Durable Power Attorney Template Examples Power Of Attorney Form Home Insurance Quotes Letter Templates

What Is Waiting Period In Health Insurance A Detailed Guide

Deduction Us 80d For Medical Insuranceexpenses Mediclaim

Insurance Claim Procedure Insurance Claim Healthcare Management Insurance

A Comprehensive Guide To Paying Health Insurance Premiums In Instalments

What Is Deductible For Health Insurance In India Bajaj Allianz

Benefitgeek Health Insurance Companies Medical Insurance Best Health Insurance

Insurance Journal Entry For Different Types Of Insurance

Second-to-die Life Insurance And When It S Appropriate By Far The Most Common Type Of Life Insurance Quotes Life Insurance Life Insurance For Seniors

Browse Our Sample Of Liability Insurance Certificate Template Liability Insurance Insurance Printable Certificate Templates

Wotw - What Is The Difference Between Co-pay And Co-insurance Health Literacy Health Planning Co Insurance

Health Insurance India Ppt In 2021 Health Insurance India Best Health Insurance Health Insurance Companies

Insurance Journal Entry For Different Types Of Insurance

Health Insurance For Students In The Netherlands - Zorgwijzer

3 Types Of Health Insurance Plans You Should Know About

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

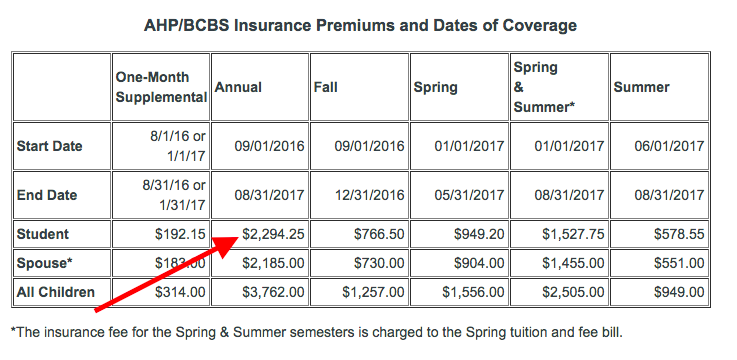

Faqs About Student Health Insurance - When And Where To Buy

What Are Top-up And Super Top-up Health Insurance Plans

Posting Komentar untuk "What Is Deductible In Health Insurance With Example India"