Self Insured Retention Vs Deductible

With a deductible policy, the insurer pays for losses and then collects reimbursement from you afterward up to the amount of the deductible. The reason is that insurance certificates, such as.

Excess Liability Vs Umbrella Liability - Ppt Download

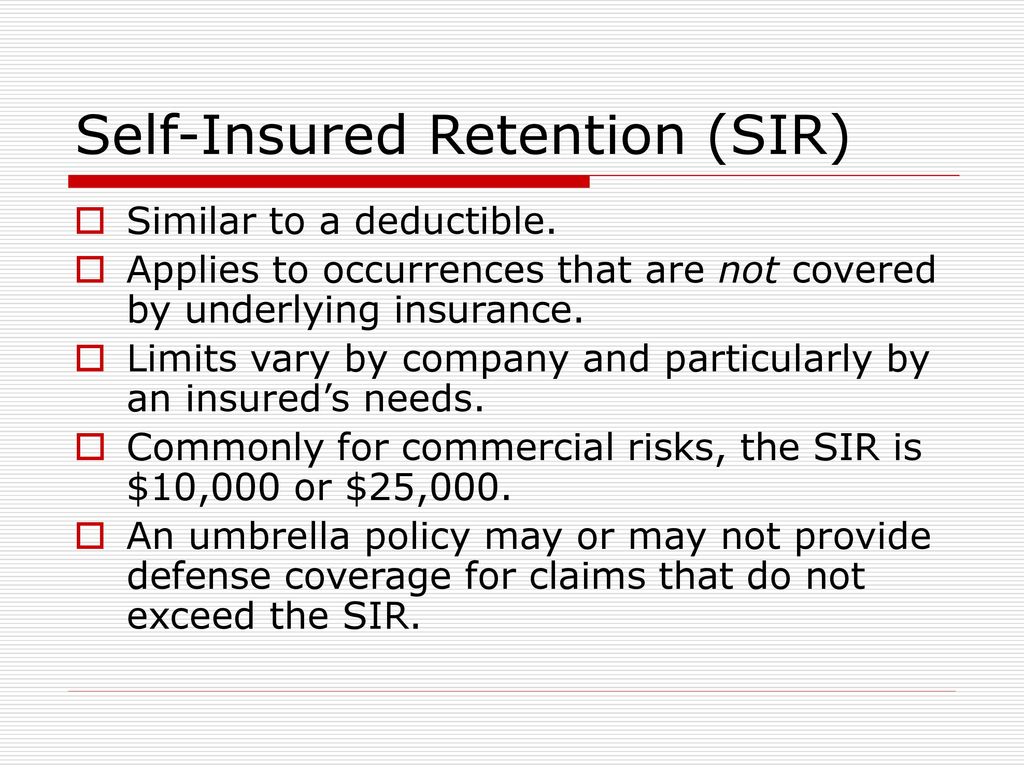

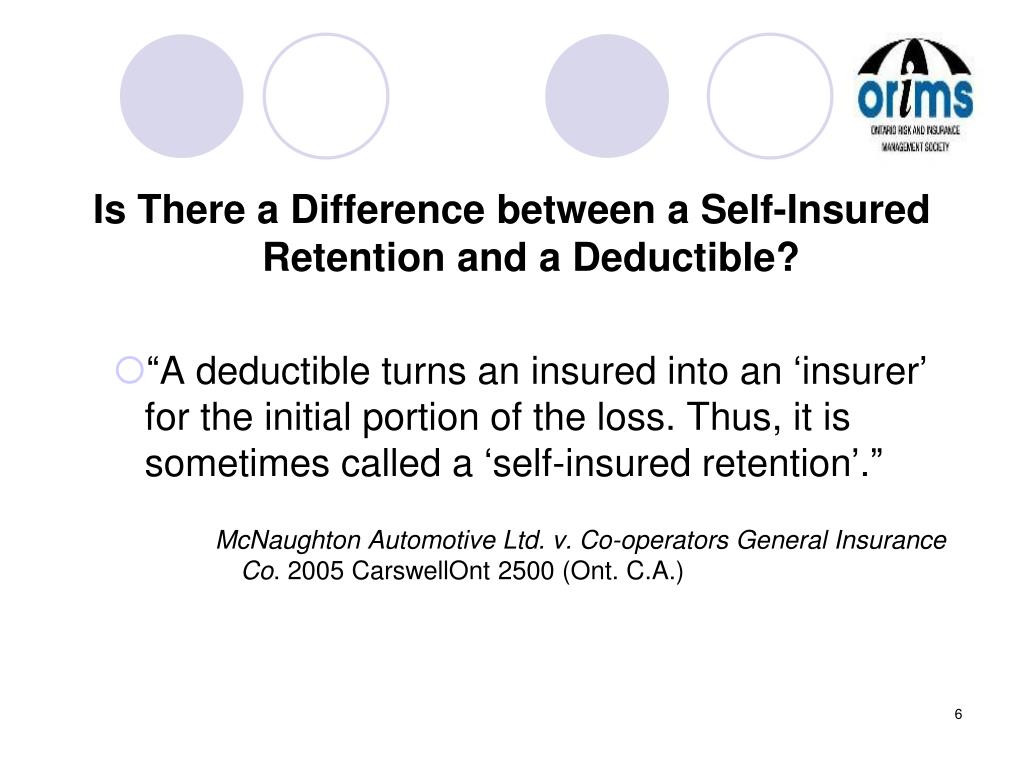

However, upon closer inspection, there are significant ramifications in choosing a sir as opposed to a deductible.

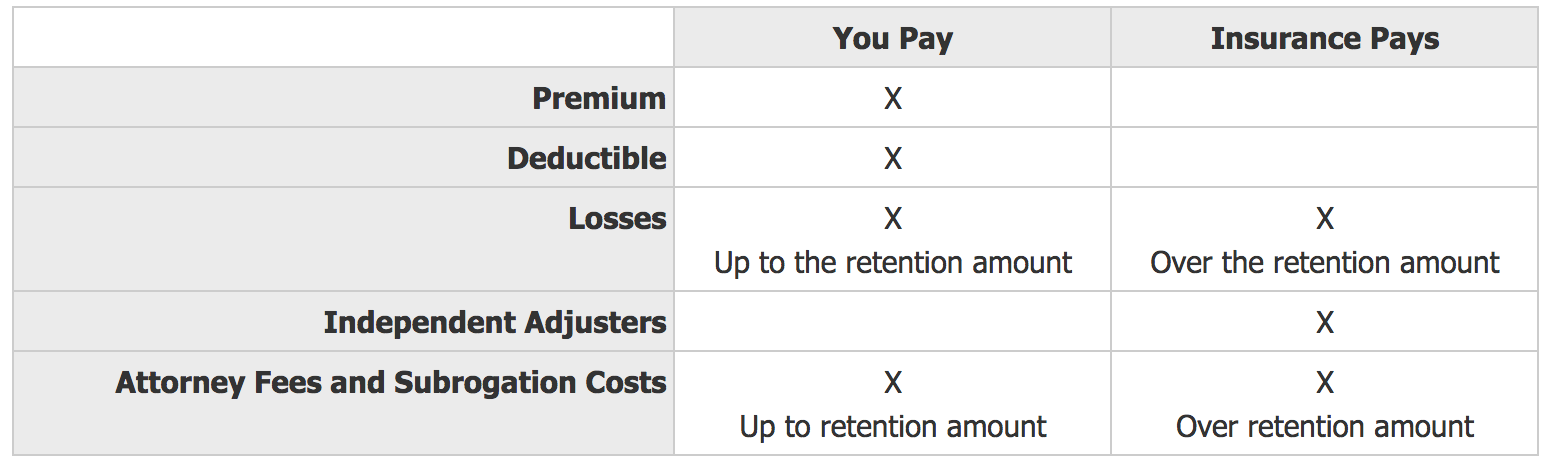

Self insured retention vs deductible. First, they both have similar structure in they both usually have both a per loss retention and an. The first is who is issuing your company “credit”. The policyholder who wants their insurance company to provide legal defense for the insurance claim from the outset may prefer a deductible, other things being equal.

But aside from that, the two are different ways of dealing with insurance claims. This is similar to a large deductible except that the insurance company is not involved in handling any claims that occur under the retention or deductible level. Deductibles and self insured retentions (sir’s) are mechanisms which require the insured to bare a portion of a loss otherwise covered by an insurance policy.

The two concepts are often confused and/or use the terms interchangeably. At first glance, a sir and a deductible appear to be similar concepts with respect to insurance policies. After they have paid the bill, they will charge you for the money they spent up to the amount of your policy’s deductible.

Protect your clients by knowing the differences between these two mechanisms. With a policy with a retention clause, you take the lead in paying a claim up to your retention limit. With a deductible, it’s the insurance company.

This feature can be used on many high cost business policies. Although these two mechanisms are economically similar, they differ in significant respects and should not be used interchangeably. When a claim needs to be paid out, it’s the insurance carrier that pays the.

The answer to the question what’s the difference between a deductible and a self insured retention is that deductibles reduce the amount of insurance available whereas a self insured retention is applied and the limit of insurance is fully available above that amount. It is an understandable mistake. The insurance company steps in only after you’ve done that.

Deductibles and sirs, however, are separate and distinct and their application can dramatically affect the defense and/or coverage obligations of both.

Ppt - Sirs Deductibles And The Importance Of Policy Language March 9 2011 Powerpoint Presentation - Id3052586

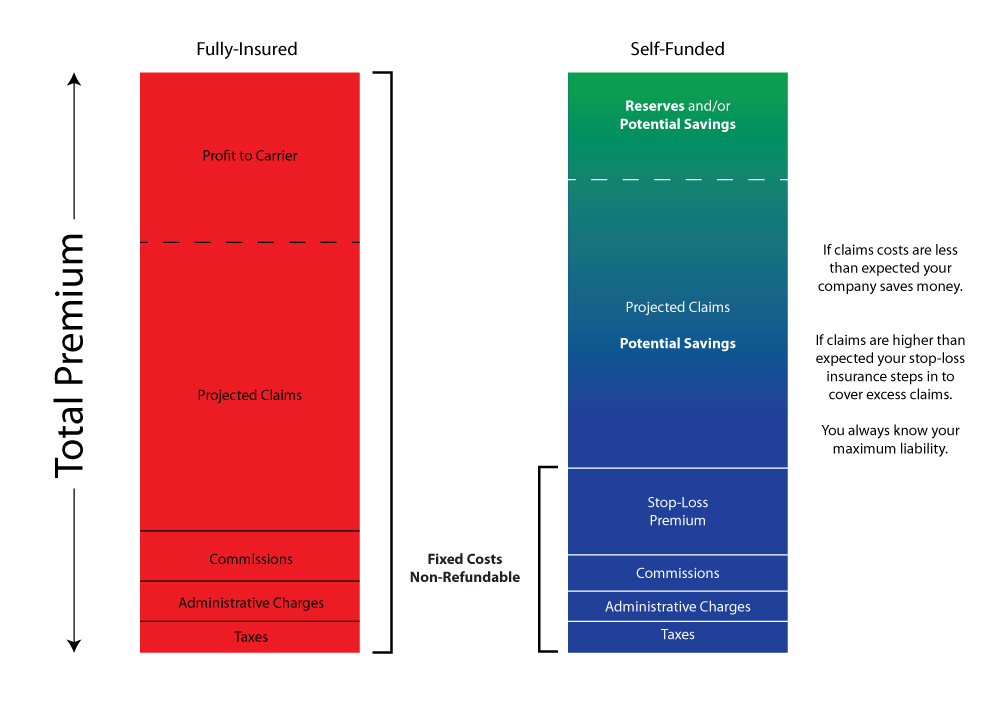

Fully-insured Vs Self-funded - Shenandoah Valley Group

Insurance Deductible Vs Self Insured Retention - Aligned Insurance

Ppt - Sirs Deductibles And The Importance Of Policy Language March 9 2011 Powerpoint Presentation - Id3052586

Self-insured Retentions Versus Deductibles Expert Commentary Irmicom

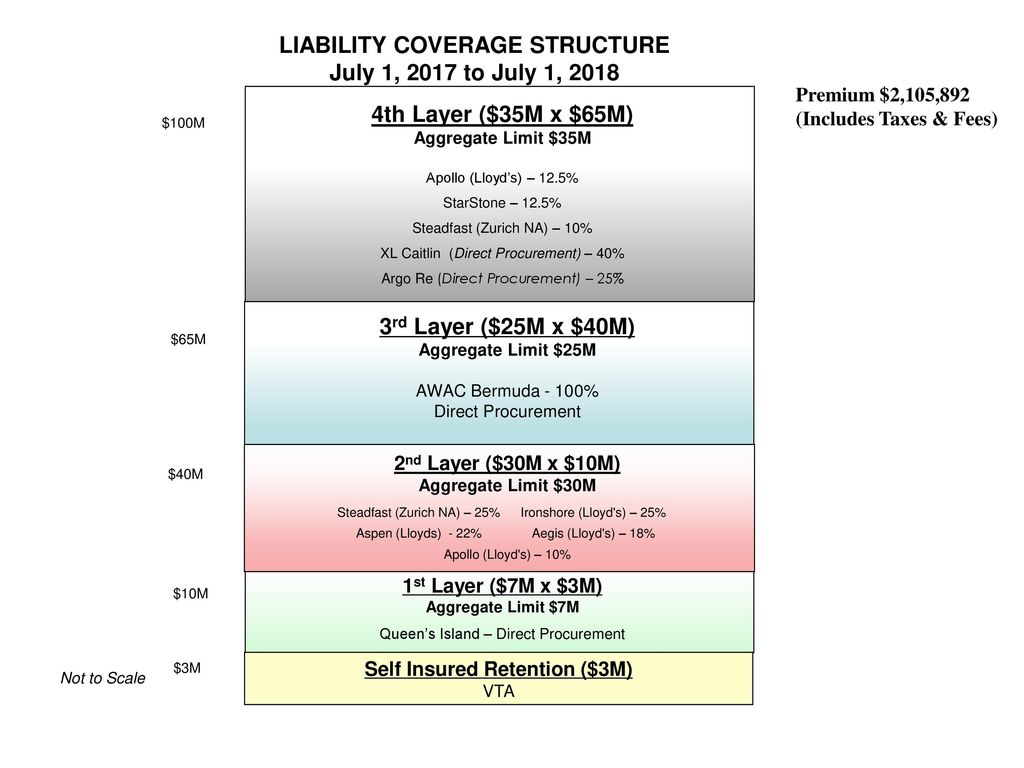

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

Self-insured Risks - Captive Insurance 101

Deductible Vs Self Insured Retention Sir Whats The Difference - Youtube

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

1 Chapter Outline 111 Traditional Insurance Contracts Basis Of Coverage Deductibles And Self-insured Retentions Policy Limits Excess Policies Layering - Ppt Download

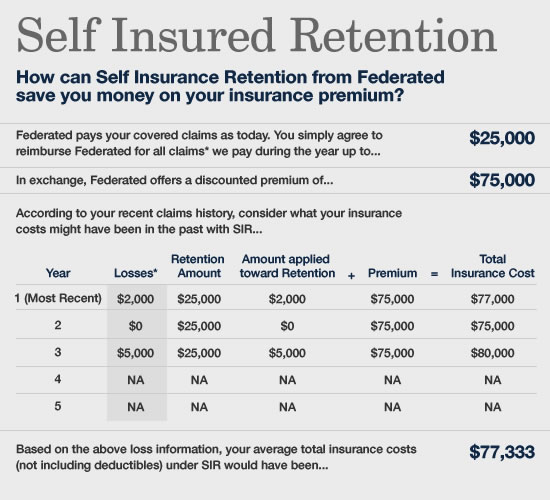

Sir A Profit Center For Your Business American International Automobile Dealers

Sir A Profit Center For Your Business American International Automobile Dealers

Self-insured Retention Vs Collateral

Deductible Vs Self-insured Retention

The Corridor Self-insured Retention Expert Commentary Irmicom

Deductibles Vs Self-insured Retention

Self-insured Retention An Alternative To The Insurance Deductible - Reshield

Large Deductible Program Cash Flow Less On Premium Retained Losses Are Deductable Catastrophic Protection Pricing Driven By Individual Risk - Ppt Download

Posting Komentar untuk "Self Insured Retention Vs Deductible"