Fdic Insurance Limits Wells Fargo

For fdic insurance limits, the current limit is $250,000 per depositor, per bank. Fortunately for consumers, there are thousands of financial institutions with fdic insurance, including wellsfargo.

Wells Fargo Logo Wells Fargo Mortgage Wells Fargo Logo Wells Fargo

On january 1, 2013 fdic insurance limits changed.

Fdic insurance limits wells fargo. As discussed in the accompanying disclosure statement, the fdic standard maximum deposit insurance amount (the “mdia”) is $250,000. The fdic insures certificates of deposit and money market accounts, along with traditional checking and savings options. Owner holds at the same entity.

It is critical to know the extent of insurance coverage when it comes to your deposit accounts. The fdic insures certificates of deposit and money market accounts, along with traditional checking and savings accounts. Terms supplement dated february 17, 2017 to disclosure statement dated december 5, 2016.

Our expanded bank deposit sweep and standard bank deposit sweep provide you with. Fidelity holds an account with wells fargo as its bank partner. Outstanding cashier's checks, money orders, loan disbursement checks, interest checks and drafts issued by wells fargo;

Who better jp morgan chase banker or wells fargo? The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. Businesses now have exposure as unsecured investors in their financial institution for aggregate deposits in excess of $250,000.

What amount of insurance coverage do i have for my accounts? Fdic insurance limits current fdic insurance covers a depositor for ‰‹šˆ,ˆˆˆ, but through our convenient, automated service you get even more protection. For example, consider an account owner with a position in the fidelity arizona college savings plan in excess of the fdic insured limit.

It was founded in 1870 and has approximately $1776.72 billion in assets. The current fdic insurance maximum is $250,000 per depositor per ownership category per bank. Fdic limits the insurance to $ 250,000.

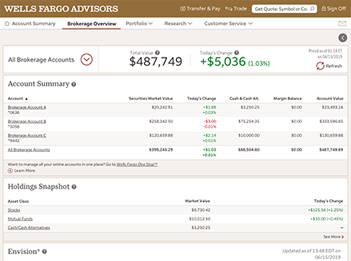

As long as these deposits are made to accounts with the same ownership classification, the fdic will only insure $250,000. At wells fargo advisors, cash deposits are covered by fdic insurance for a total of at least ‰‡šˆ,ˆˆˆ if you are enrolled in our bank deposit sweep program.* through this Customers can open an account at one of its 6,371 branches.

How much is covered under fdic insurance limits? Fdic protects certificates for deposit and cash market accounts, as well as traditional test and savings accounts. These limits can get complicated, though the general rule of thumb is that the fdic insures.

The federal deposit insurance corporation (fdic) is an organization that guarantees certain types of bank accounts in the united states. Local banks offer a way around fdic insurance limit a program referred to as cdars, certificate of deposit account registry service, offers additional insurance on deposits larger than the. Federal deposit insurance corporation each depositor insured to at least $250,000 per insured bank

The fdic insures certificates of deposit and money market accounts, along with traditional checking and savings accounts. For unlimited protection, shira can easily maintain all her corporate accounts at a. The deposit amount of a cd is insured by the fdic, subject to applicable fdic insurance limits.

Fdic insurance limits cap at $250,000. With the wells fargo advisors bank deposit sweep, you can have up to $1,250,000 ($250,000 per depositor, per insured bank for each account) federal deposit insurance corporation (fdic) insurance for deposits in your wells fargo advisors account when deposits are held at all five program banks in the expanded bank deposit sweep program. Fdic protects certificates for deposit and cash market accounts, as well as traditional test and savings accounts.

Fdic insurance limits cap at $250,000. Fdic insurance limits cap at $250,000. Wells fargo bank, national association is an fdic insured institution located in sioux falls, sd.

Fortunately for consumers, there are thousands of financial institutions with fdic insurance, including wellsfargo. Aggregate deposits comprise all demand deposit accounts, savings, certificates of deposit and other accounts that are under the same tax identification number or when there are different tax identification numbers for. Fdic limits the insurance to $ 250,000.

For more information about fdic insurance coverage, please visit the fdic web site at. All assets of the account holder at the depository institution will generally be counted toward the aggregate limit. Sifis, including bank of america, jp morgan chase, wells fargo, citigroup, and a few others, therefore operate under the federal government’s unofficial but acknowledged umbrella of protection (even above fdic insurance limits).

Is my money safe with wells fargo? Fdic insurance limits current fdic insurance covers a depositor for up to $250,000 per account ownership category (e.g., individual, joint, trust) per financial institution. Some investments such as mutual funds, stocks, and life insurance policies are not insured at all, and other investment accounts are covered based on a number of fdic limits.

The fdic standard maximum deposit insurance amount for deposits is $250,000 per depositor, per insured financial institution, for each account ownership category. Therefore, you would have $250,000 of uninsured deposits at wells fargo.

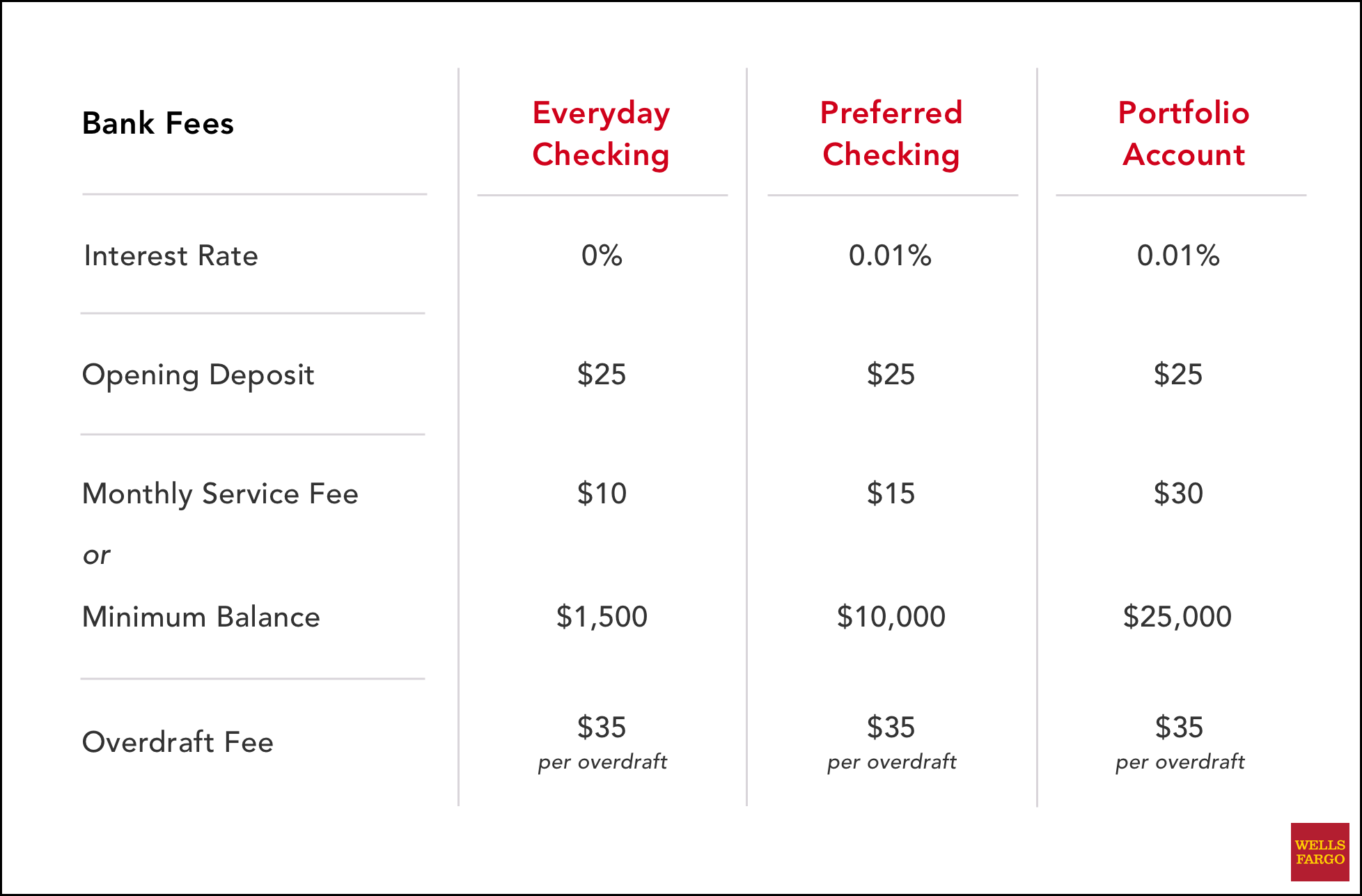

Onjuno Wells Fargo Checking And Savings Accounts Fees 2021

Wells Fargo Agrees To Pay 3 Billion Penalty The Taylorsville Times

Ten Banks Hold 70 Percent Of Nm Deposits Fdic Reports - Albuquerque Business First Deposit Albuquerque Bank Of The West

Feds Asset Cap Limits Wells Fargo From Helping Small Firms - Nasdaq In 2020 Wells Fargo Nasdaq Fargo

Wells Fargo Business Card Rewards Raising Your Rewards To New Heights

Onjuno Wells Fargo Checking And Savings Accounts Fees 2021

Live Your Legacy Philanthropic Services - The Private Bank - Wells Fargo

Wells Fargo Everyday Checking Review November 2021 Findercom

Wells Fargo - Beranda Facebook

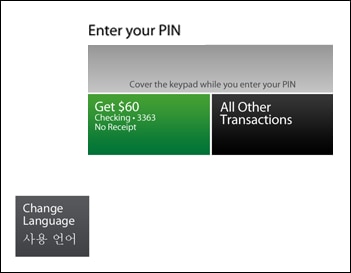

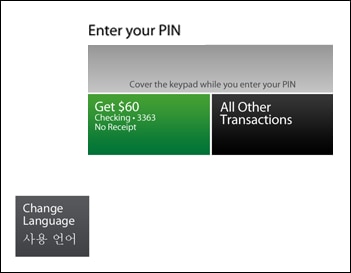

Wells Fargo Atm Features Wells Fargo

Enroll In Wells Fargo Online 1 Enroll In Wells Fargo Online 1 Demo

Account Summary And Activity Wells Fargo Business Online Overview

How To Switch Your Bank Accounts - Wells Fargo

Social Impact Investing - Make A Difference With Your Investment Choices Video - Lloyd Kurtz - The Private Bank

The Federal Reserve Cracks Down On Wells Fargo Over Scandal Involving Sham Accounts Wells Fargo Rewards Credit Cards Fargo

Online Investing - Online And Mobile Overview - Wells Fargo

Wells Fargo Newsroom - Wells Fargo Promotes Whitney Wall To South Texas Middle Market Banking Leadership Team

Wells Fargo Review Should You Open An Account - Valuepenguin

Wells Fargo Personal Loans Review 2021

Posting Komentar untuk "Fdic Insurance Limits Wells Fargo"