Do You Have To Pay Deductible For Roof Replacement

If your roofing contractor offers to waive your roof replacement deductible, don't do it! Stay informed on what’s happening in your own backyard and subscribe today!

Insurance Claims What Are Roof Replacement Deductibles - Goodrich Roofing

Once your deductible is met, in most cases the insurance company pays the rest.

Do you have to pay deductible for roof replacement. When an invoice of $10,000 or greater is received from a roofing. Document the damage and contact your insurance company Roofers offering to waive roof replacement deductibles, giving you a “free roof,” is a longstanding practice in many states.

Here’s what you need to know about paying your deductible now that hb 2102 has been passed. It is a question that confuses many homeowners, and stonewater roofing hears it often. Just to make sure we're all on the same page of fine print, a deductible is a specific amount of money that you the homeowner pay toward the cost of an insurance claim—in this case, replacing your roof.

We had hail damage to our roof and some window trim and have replacement cost insurance with a $2000 deductable. You'll still have to pay your policy deductible before your coverage kicks in. The insurance company will take care of the rest.

Hb 2102 (a new texas law, starting september 1st, 2019), now requires all texas homeowners to pay. Often people do not have the extra money to pay an expensive deductible but still need the roof replaced to prevent further damage. Of course, we would all rather not pay the deductible when dealing with insurance claims.

Let them negotiate the cost of your roof replacement and pay your full & legally required deductible. What if a roofer can do the job for $10,500.00 that your adjuster said would be around $12,000.00? It’s a very similar process.

If, for example, a home suffered roof damage after a strong storm, insurance adjusters would determine the cost of. Rather, the amount paid adds to your home’s cost basis and reduces any capital gain when you sell the property. Most people have not needed to make a roofing or home repair claim with their insurance company, but may have done so with their car insurance.

Instead, hire a company that will work with your insurance agent. In fact, for any loss above $1,500.00, your part would always be the same, your deductible. You can get financing to cover your deductible and any other work you might want to have performed while we are already at your home.

The full replacement cost of the roof is $10,000. With many home insurance companies, assuming that you have a replacement cost policy on the roof, they will release an amount of money equal to the depreciated value of the roof and other structures affected by the claim event less the deductible owed. If you have questions about your roof coverage, call your insurance agent and request more detail.

This means you will get a percentage of the replacement cost based on the roof’s material and age. In nearly every situation, the answer is yes. For example, if a new roof costs $8,000, and your deductible is $1,000, your insurer will pay for $7,000 of the roof.

But it is what it is. Shopping for a better roof price does not save a deductible If you have a problem with your deductible, maybe the quality roofing company can finance it.

Repair coverage usually takes into consideration depreciation of the roof. If not then maybe you need to rethink your premiums. Shopping for a better roof price does not save a deductible.

However, a good roofing contractor will be trained in how to work directly with your insurance. You are only required to pay your deductible: In this example the roof is 15 years old and the policy owner’s deductible is 1% of insured amount ($1,000).

The property owner has a $1,000 deductible, which is removed from the estimate. Insurance deductibles can range from $500.00 to 4% of the policy coverage amount ($10,000.00 or higher). Some insurance claims for roofs are initially denied, and some are paid out on a depreciated value for the roof.

You may also have to pay any deductible amount that you chose for your policy before the insurer will pay anything. The roof is not in brand new condition, so the deterioration of the roof (we’ll give it $5,000 to make it easy) is removed from the estimate. The insurance company estimated total replacement cost of $13,000 and depreciation of $4000 and gave us a check for $7,000 (depreciated value less deductible).

Have you been waiting to repair or replace your roof? If you have a $12,000.00 loss, your insurance company would owe you $10,500.00 as the deductible amount. In the past, insurers doled out lump sum payments to homeowners when losses occurred, and the deductible was removed from the total sum.

In these cases, baker roofing & construction offers financing through hearth. This money should be used to make a down payment to the contractor to initiate the work to be. Did you just find a way to save your deductible?

Each insurance policy is different Homeowners to pay full roof replacement deductible under new law house bill 2102 goes into effect sept. If your new roof costs $8000 and your deductible is $1500, your insurance provider will pay the remaining $6500 for the roof.

Do you have to pay your insurance deductible? $1,500.00 would be paid by you. A home insured for $100,000 has a totaled roof from a hail storm, and the cost to replace the roofing system (replacement cost value) is $10,000.

In summary, there is no immediate deduction allowed for the cost of a new roof for a personal residence. So, if you are getting a roof replacement, you may qualify for tax credits. They will be able to assist you in getting any and all insurance compensation that you may be entitled to for your new roof.

If the roof damage was caused by you or an inexperienced (or unlicensed!) roofer, your roof replacement will likely not be covered either. However, you should make sure that the roofing material used in your roof is certified metal or asphalt with pigmented coatings or cooling granules. The main check is written for $4,000 instead of $9,000.

Once your insurance company has decided to replace your roof the next question may be how much “out of pocket” expense will it cost me? For those who are unaware, deductibles are a set amount that homeowners themselves will have to pay toward the cost of their insurance claim, such as a roof replacement. You can find just about everything you need to know about depreciation here.

Is It Legal For A Roofer To Cover My Insurance Deductible

4 Things You Need To Know About Roof Replacement Deductibles - Patriot Roofing Llc

Roof Replacement Deductibles How Theyre Calculated

Homeowners To Pay Full Price For Roof Replacement Deductibles Under New Law Community Impact

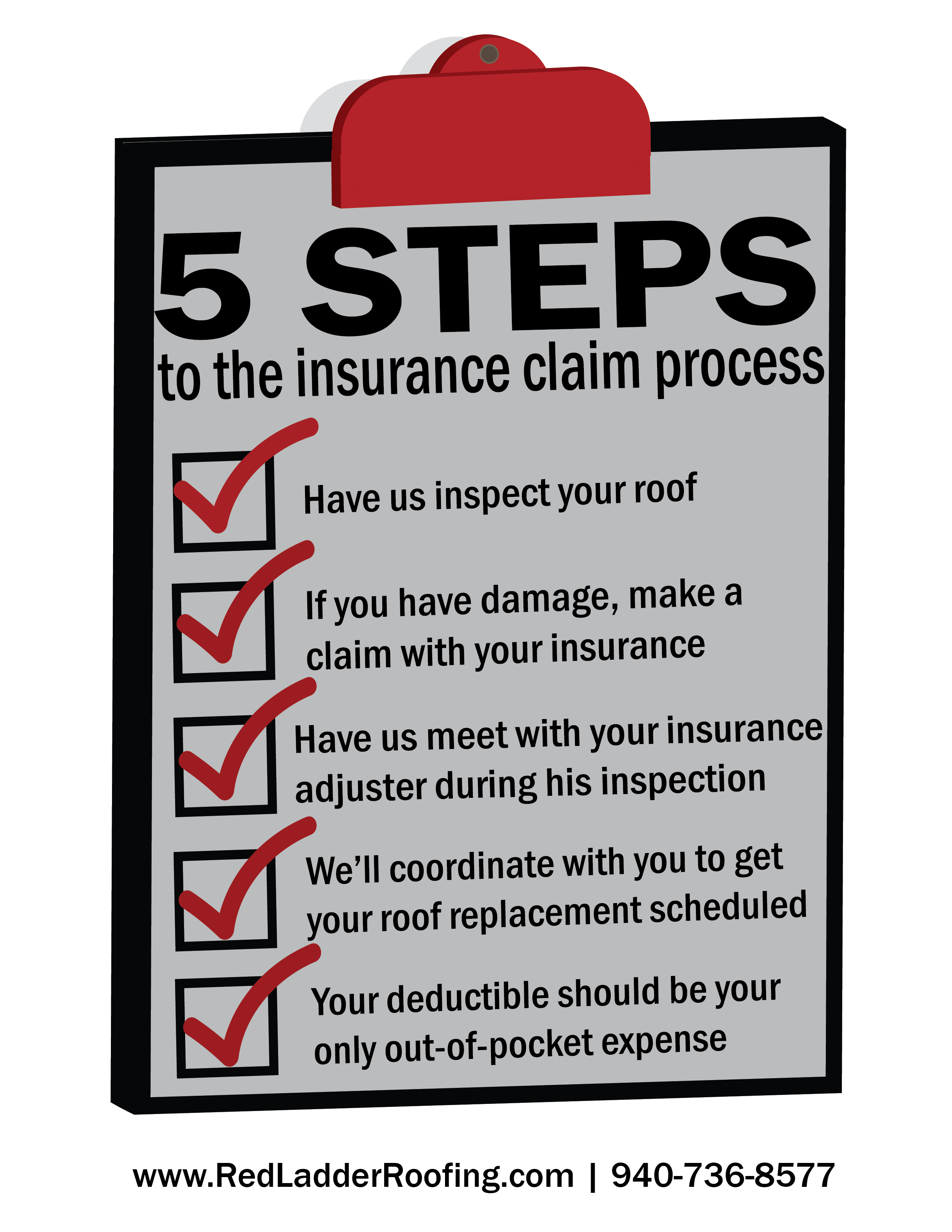

5 Steps To The Insurance Claim Process - Red Ladder Roofing Construction

How Long Does A Roof Last Age Of Roof And Insurance Harry Levine

Is Roof Replacement Tax Deductible Residential Roofing Depot

Does Homeowners Insurance Cover Roof Damage Allstate

How To Make A Home Insurance Claim For Roof Damage Forbes Advisor

What To Know About Paying Your Insurance Deductible In Texas

Why Should I Pay My Full Roof Replacement Deductible

Roof Replacement Deductibles Networx

Better Pay Your Full Roof Replacement Deductible Prestige Roofing

Why You Should Call A Roofer Before Your Insurance Company

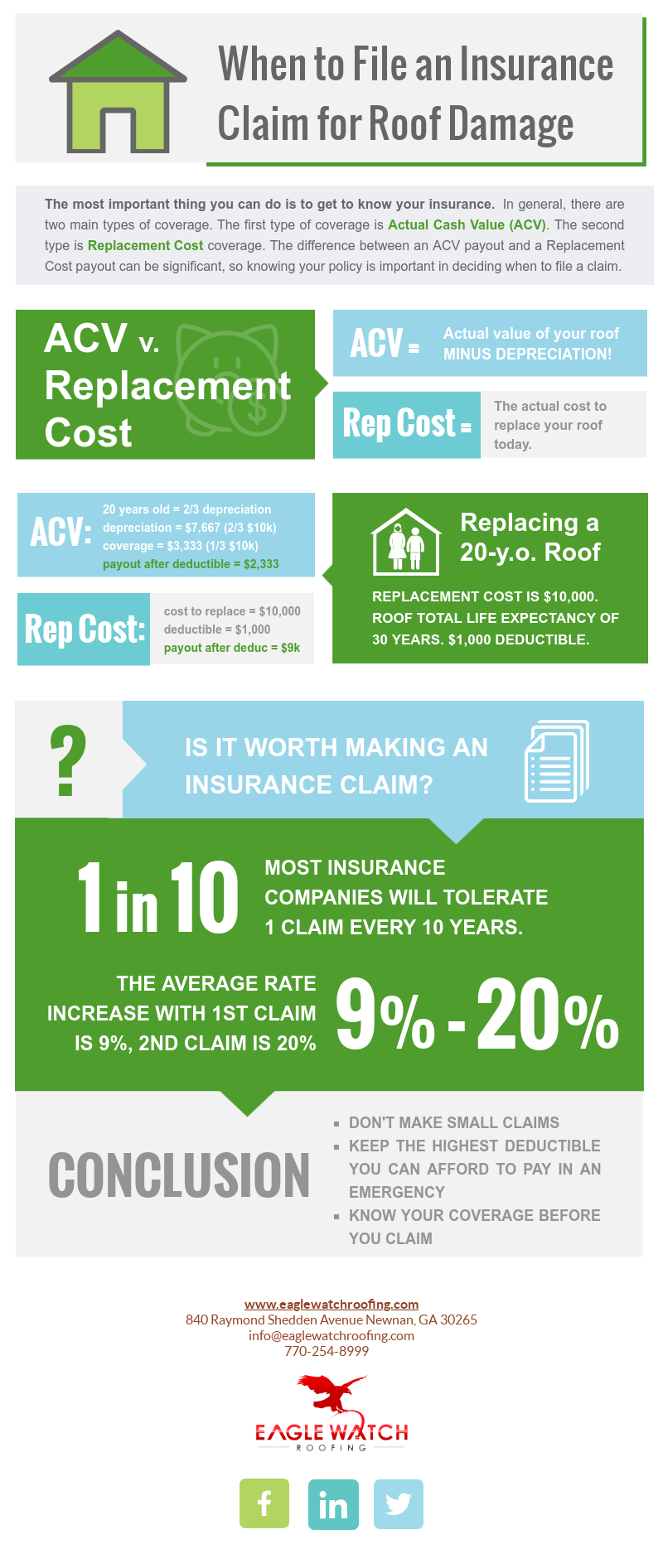

When To File Insurance Claim For Roof Damage

How To Get Homeowners Insurance To Pay For A New Roof

What Is A Roof Replacement Deductible How Is It Calculated - Jack The Roofer

Roof Replacement Cost 5 Ways To Pay For It Student Loan Hero

Homeowners To Pay Full Roof Replacement Deductible Under New Law Community Impact

Posting Komentar untuk "Do You Have To Pay Deductible For Roof Replacement"