Which Of The Following Best Describes Guaranteed Renewable Term Life Insurance

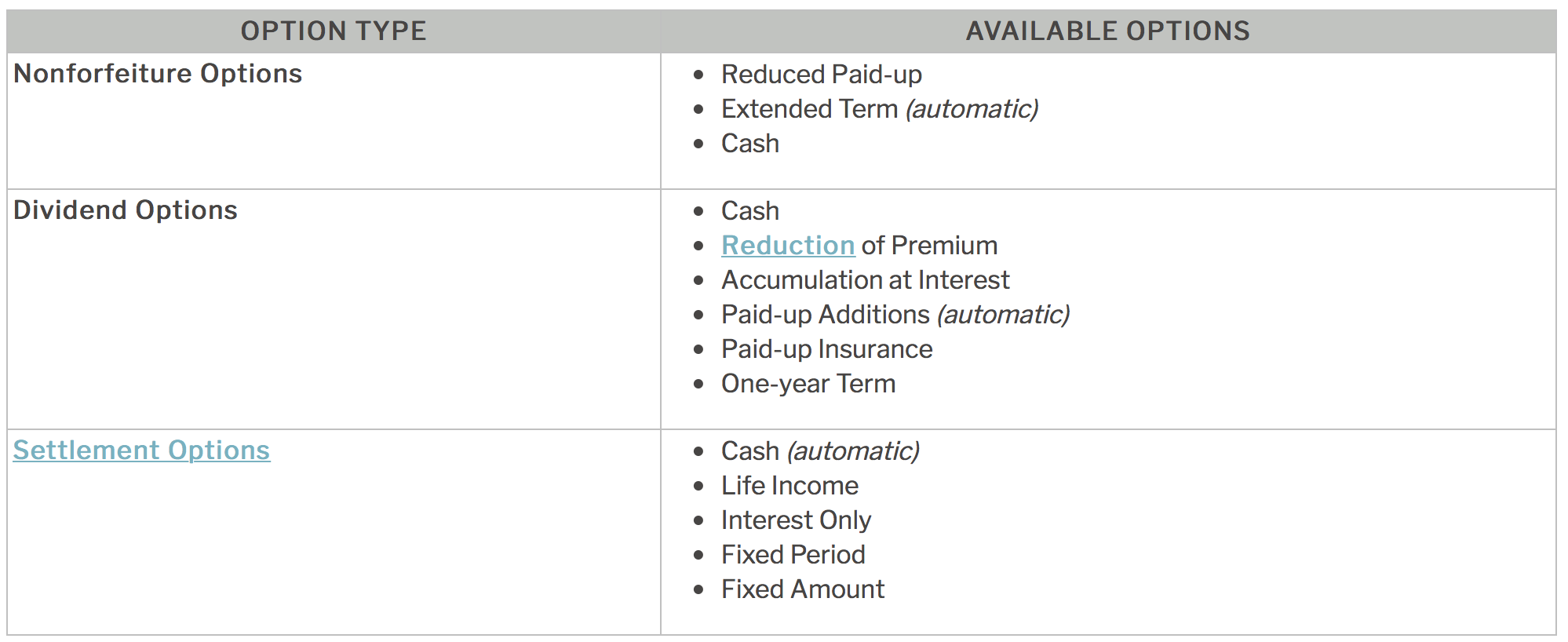

At age ninety, ignoring other premium elements and adverse selection, the mortality cost would be $22,177 (0.22177 × −$100,000). At the age 47, the insured decides to cancel his policy and exercise the extended term option for the policy's cash value, which is currently $20,000.

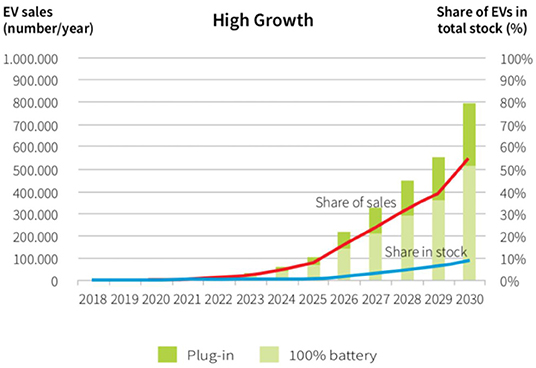

Frontiers Energy Transition And Sustainable Road Transportation In Turkey Multiple Policy Challenges For Inclusive Change Sustainable Cities

At the end of this term period, almost every company gives you the option to renew your policy without having to.

Which of the following best describes guaranteed renewable term life insurance. Ten year term insurance for a person aged 45 c. Both permanent life insurance and final expense insurance are guaranteed renewable. The life insurance policy clause that prevents an insurance company from denying payment of a death claim after a specified period of time is known as the a registered nurse who may complete a paramedical report?

A) the policy has cash values and nonforfeiture values. The death benefit remains level, but the premium increases each year with the insured's attained age. Interest rates range from 8 to 12%, whereas ordinary whole life is 3 to 6%.

A deferred annuity cannot be surrendered prior to annuitization. Annually renewable term annually renewable term is the purest form of term insurance. A convertible insurance policy is a term related to life insurance.

The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender. How annually renewable term insurance works. Universal life policies have a guaranteed minimum rate, usually 5%.

Unlike traditional term life insurance, premiums start low and increase every time you renew your policy. Yearly renewable term insurance for a person aged 45 Renewable term life insurance guarantees the policy can be renewed to a predetermined date or age, regardless of the insured's health status.

All of the following statements regarding term life insurance are correct except. Under uniform required provisions, proof of loss under a health insurance policy normally should be filed within. Annual renewable life insurance works just like a term life policy with a longer coverage period.

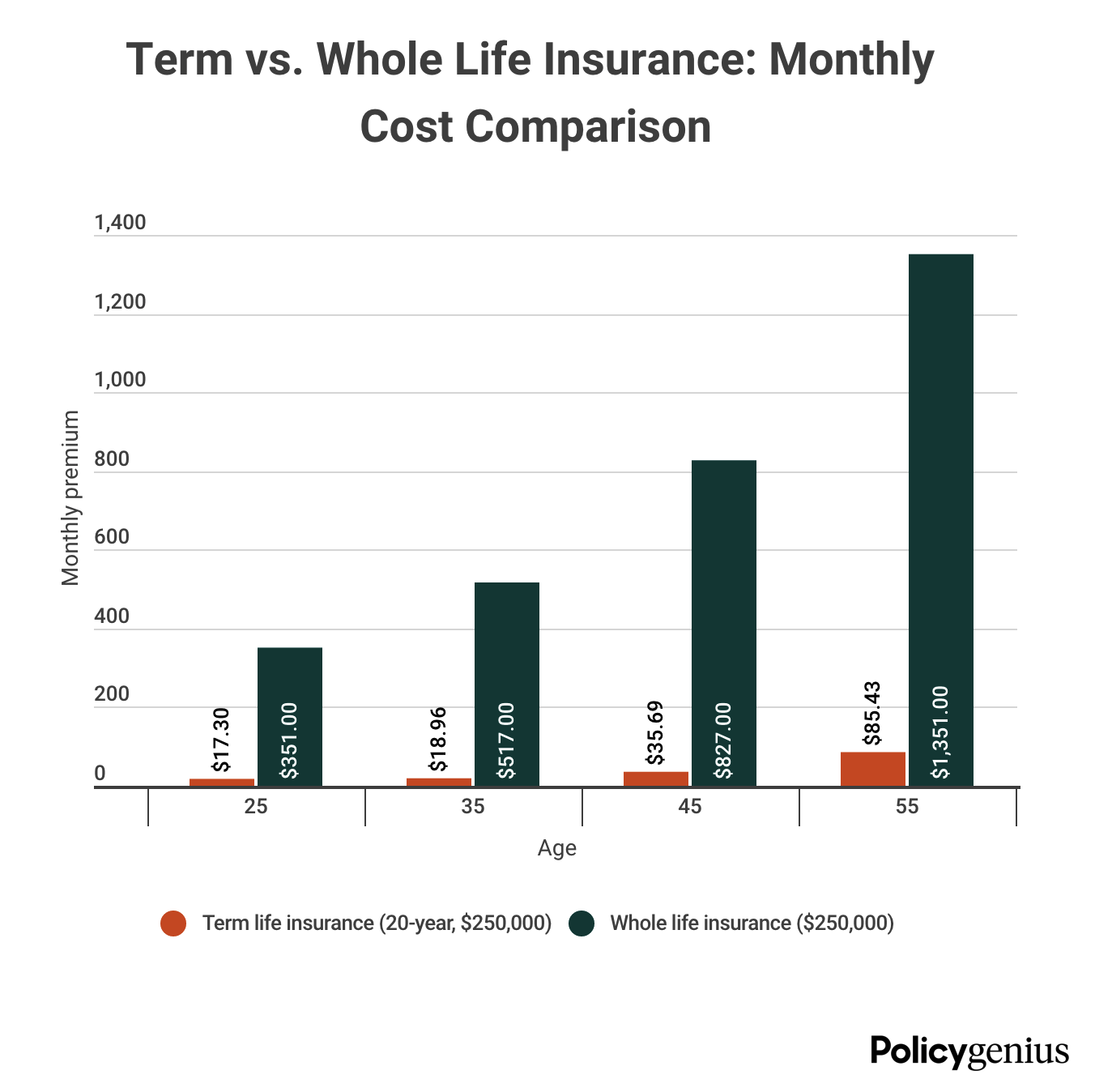

When you shop for term life insurance, make sure to look at the company’s financial strength rating provided by agencies such as am best and standard & poor’s. A renewable term life insurance policy can be renewed at a predetermined date or age, regardless of the insured's health. Even guaranteed renewable term policies with accelerated benefit riders will be cheaper than the cheapest form of permanent coverage.

Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical exam. Term life insurance is a policy that provides the insured person coverage for a certain period of time. When a ten year renewable term life insurance policy issued at age 45 is renewed, the premium rate will be the current rate for a.

As for term life insurance, your policy is only guaranteed renewable until the term is up. What is not true about beneficiary designations? The beneficiary must have insurable interest in the insured.

Thus, just the mortality element of the annual premium for a $100,000 yearly renewable term life insurance policy would be $6,419 (0.06419 × $100,000). A universal life insurance policy is best described as : Renewable term refers to a clause in many term life insurance policies that allow for its renewal without the need for new underwriting.

Compared to ordinary whole life policies, universal life interest rates are: Ten year term insurance for a person aged 55 b. Renewable term life insurance policies may be renewed by the insured as long as evidence of insurability is provided.

Which of the following terms best describes a life insurance policy that provides a straight $100,000 of coverage for a period of five years. The surrender value should be equal to 100% of the premium paid, minus any prior withdrawals and surrender charges. Applicant’s promise to act in good faith d.

Which of the following best describes the difference between pure life and life with guaranteed minimum settlement options? With renewable term, coverage can be extended even if. Which of the following best represents what is meant by “life insurance creates an immediate estate”?

When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. An insured purchased a health insurance policy with a renewability clause that states the policy is “guaranteed renewable.” this means that as long as the required premiums are paid, the policy will continue until the insured Which of the following considerations is required by the life insurance company to make the insurance coverage effective?

What is renewable term life insurance? An annually renewable term policy with a cash value account: Yearly renewable term insurance for a person aged 55 d.

Payment of each renewal premium before the end of applicable period This feature is also called a conversion privilege, guaranteed renewable, or guaranteed insurability. C) the death benefit will always be paid to the estate of the insured.

An insured owns a $50,000 whole life policy. Beneficiary’s continuing insurable interest in the life of the insured b. On the other hand, a.

Renewable term life insurance policies can only be renewed by the insurance company, and the insured must provide evidence of insurability. Payment of the initial premium c. In decreasing policies, while the face amount decreases, the premium remains constant throughout the.

How to find the best term life insurance policy. B) the policy generates immediate cash value. Universal life policies tend to have higher interest yield compared to whole life.

Renewable Methanol Synthesis - Roodegutzmer - 2019 - Chembioeng Reviews - Wiley Online Library

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Panama In Imf Staff Country Reports Volume 2007 Issue 067 2007

Term Vs Whole Life Insurance Policygenius

How To Pair Fonts Like A Pro Branding Website Design Website Design Website Branding

Which Of The Following Best Describes Annually Renewable Term Insurance

Other Life Topics Flashcards Cheggcom

Exploring The Future Of Carbon Capture And Utilisation By Combining An International Delphi Study With Local Scenario Development - Sciencedirect

:max_bytes(150000):strip_icc()/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

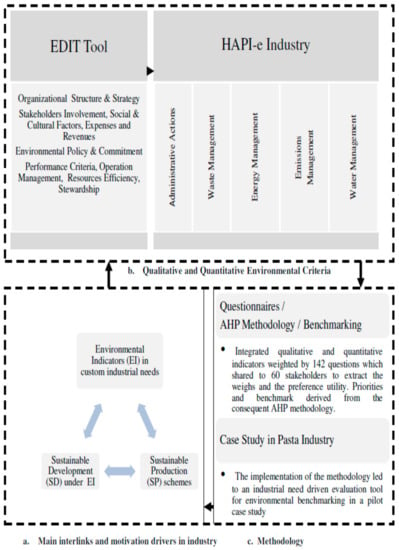

Sustainability Free Full-text Development Of A Holistic Assessment Framework For Industrial Organizations Html

Sustainability Free Full-text An Optimization Model Fitting The Neighborhood Sustainability Assessment Tools Html

Profitability And Balance Sheet Repair Of Italian Banks In Imf Working Papers Volume 2016 Issue 175 2016

Guaranteed Renewable - Overview Types Characteristics

Profitability And Balance Sheet Repair Of Italian Banks In Imf Working Papers Volume 2016 Issue 175 2016

Types Of Policies Department Of Financial Services

Law Of Conservation Of Mass - Google Search Chemical Equation Conservation Of Mass Equations

Posting Komentar untuk "Which Of The Following Best Describes Guaranteed Renewable Term Life Insurance"