When Should I Buy Life Insurance

Depending on the overall market value, your cash value can increase rapidly. The most commonly recognized case of this is parents with young children.

When Is The Best Time To Buy Life Insurance Insurance Investments Financial Wellness Life

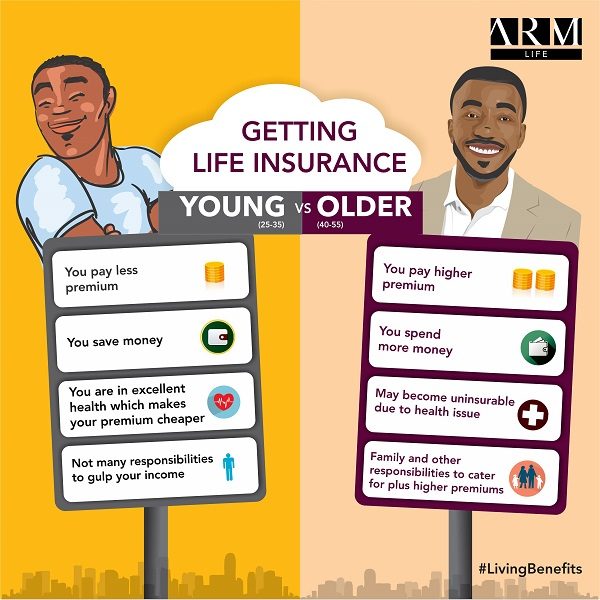

It’s never too soon or too late to buy life insurance.

When should i buy life insurance. If you die, you want them to be able to go to college and maintain a semblance of the lifestyle they enjoyed when you were alive. The right time to buy life insurance varies from person to person, depending on family and financial circumstances. I hope to see a future influx of these questions which i will be happy to answer.

Even if you have life insurance through your workplace, you may want to buy additional life insurance. Having cash value is one of the advantages of a universal life insurance plan. Whether you can only afford term life insurance at this time or can get a whole life policy, life insurance is not something to “wait until you need it”.

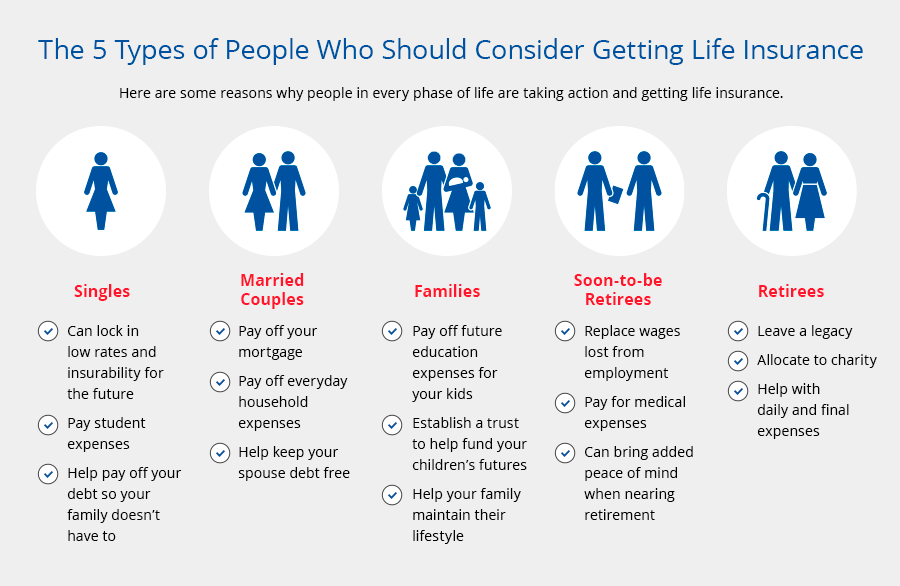

You should purchase life insurance (always term) when you have dependents whose futures are contingent on the future earnings you expect to have. If people depend on your income, life insurance can replace that income for them if you die. For many people, the necessity for life insurance is not realized until something happens to open their eyes, whether someone unexpectedly dies or they lose someone close to them.

You should buy insurance when you come to realization that life insurance is a necessity. The death benefit can help compensate a family for your lifetime income. You pay small amounts at monthly intervals, so that.

Life insurance is an agreement in which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the. As the name implies, term life is life insurance. First, while we all have dreams of living a long life, the unfortunate reality is that death can come suddenly and unexpectedly.

Life insurance is also routinely used to fund buy/sell agreements, which specify that the estate of the deceased will sell and the surviving partner or partners will buy the decedent’s. Money to help pay for the deceased’s funeral and other final expenses. At this stage in your life, you may still have a mortgage or dependent children.

It's also morbid, at least compared to other financial services. Term life provides temporary coverage for a set amount of time (for example, 10, 15, or 20 years). Should i buy life insurance 👪 sep 2021.

With whole life, you pay premiums throughout your life, and when you die, the insurance company pays your beneficiary (if the benefit is payable under the terms of the policy). You may have even bought a cottage or a vacation. Not only will it give you peace of mind, but it will also provide your loved ones with financial support after you die.

I am so happy to see all these responsible people looking at life insurance and when should you buy it! Another advantage of universal life insurance plans is that they come with lifelong coverage. It can be extremely difficult to sell a house quickly if you need the money, and a life insurance policy can help your loved one make mortgage payments if they decide to stay in the home.

Life auto home health business renter disability commercial auto long term care annuity. Assuming you die when you’re supposed to…around your life expectancy…in order to have your life insurance in force, so you can win the game…you have to own a policy that cannot be canceled by the insurance company before you die and won’t expire before you die, and that has a predictable, affordable, level premium that can never be raised by the insurance company in order to force you out. Many financial experts consider life insurance to be the cornerstone of sound financial planning.

Life insurance is designed to protect your beneficiaries in the event of your death. The basics of life insurance are easy to understand. Generally, you need life insurance if other people depend on your income, or if.

Life insurance in your 40s, 50s, 60s and beyond. It can be an important tool in the following situations: The principle behind life insurance is simple, in theory.

Most agents do recommend buying life insurance if you share a mortgage with someone. Procrastinating on the purchase of life insurance can be a big mistake for two reasons: It can also provide cash to pay any debts or business expenses you leave behind.

This is what many people think of when we talk about life insurance; There are two main types of life insurance: If you decide to buy a personal life insurance policy, here are three mistakes you should avoid:

Maximum age varies by life insurance company, although it's often possible for people in their 60s or 70s to buy term life insurance.

Life Insurance 101 All The Basics You Need To Know About

Buying Life Insurance Policy Dont Ignore These 5 Thingsaegon Life Blog Read All About Insurance Investing

The Who Why When For Life Insurance Canada Protection Plan

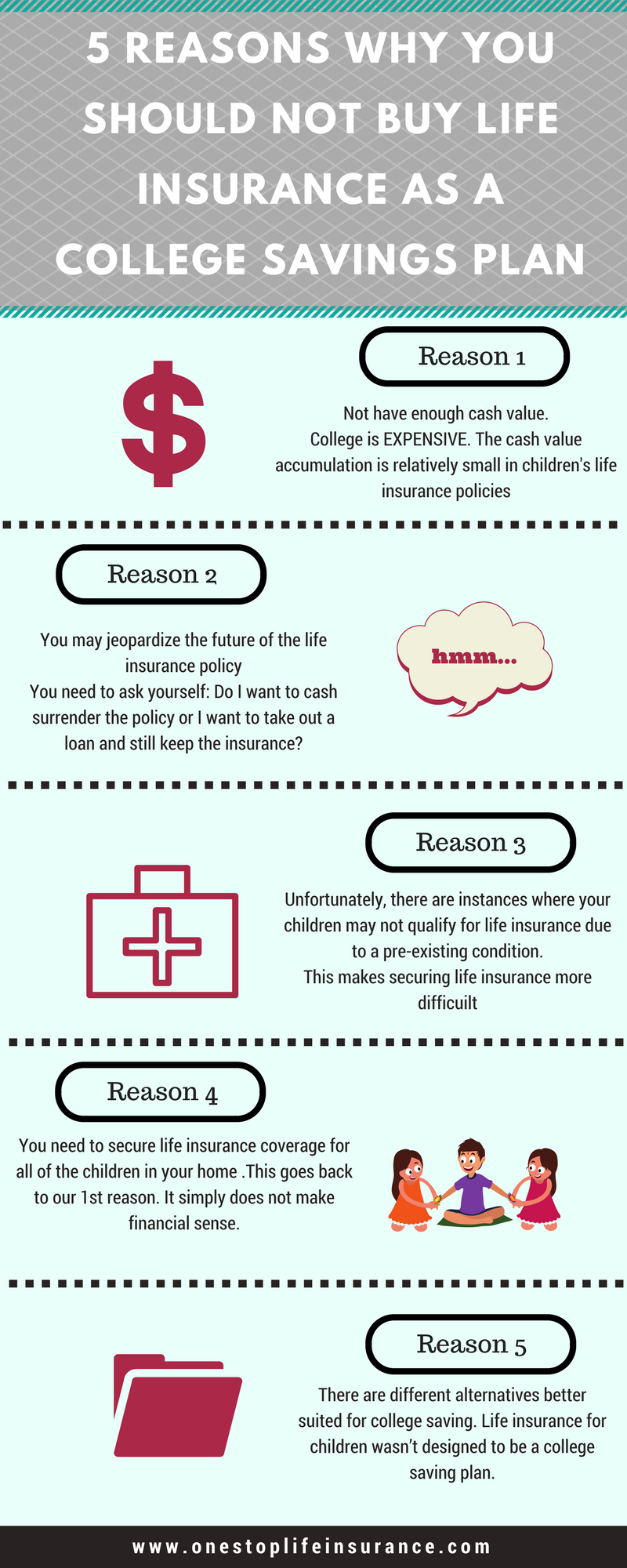

Top 5 Reasons Why Not To Buy Life Insurance As A College Savings Plan

The Official Guide To Getting Your Life Insurance Policy To 50 A Month

What Age Should You Buy Life Insurance - Sbli

When Should You Buy Life Insurance L Gerber Life

How Much Life Insurance Do You Need Farm Bureau Financial Services

The Best Time To Get Life Insurance Aaa Life Insurance Company

When To Buy Life Insurance At What Age Should You Buy Life Insurance

How To Get Life Insurance For Parents The Ultimate Guide

Should One Buy Life Insurance Or Term Insurance

Why Should You Get A Life Insurance Policy - Onhike

Heres Why Youre Not Too Young To Buy Life Insurance Bellanaija

Decision Tree When Should You Buy Life Insurance - Aafp Insurance Program

The Wrong Reasons To Buy Life Insurance

7 Reasons You Should Have Life Insurance Are You Retirement Ready

When Is The Right Time To Buy Life Insurance

Is It Ever Too Late To Buy Life Insurance - Allbusinesscom

Posting Komentar untuk "When Should I Buy Life Insurance"