Guaranteed Insurability Rider Intervals

These coverage increases can help your policy keep up if your financial. A guaranteed insurability rider, also called a gi rider, is a life insurance rider that allows the owner of a life insurance policy to buy additional life insurance with no underwriting.

:max_bytes(150000):strip_icc()/MassMutual_Recirc-f15084d2576042bca53af17ac37964ef.jpg)

Guaranteed Insurability Rider What Is It

Insuranceopedia explains guaranteed insurability option.

Guaranteed insurability rider intervals. Guaranteed insurability the guaranteed insurability rider gives you the option to buy a stated amount of additional insurance at specified intervals up to a maximum age, usually 40, without presenting evidence of insurability. This rider is typically only offered with whole life insurance policies. A guaranteed insurability rider allows you to increase the death benefit of your life insurance policy at specific intervals without taking a new medical exam or answering additional questions.

Riders are sometimes added at a cost, or sometimes they may be a free benefit included with the contract. This is an addition that allows the insured to acquire coverage at regular intervals until they reach a certain age limit, such as 40. That’s when you have the option to modify your coverage without your health impacting your guaranteed insurability rider life insurance rates.

The guaranteed insurability (gi) rider is also called “additional purchase option.” this rider allows you to buy additional life insurance coverage (or death benefit) at specific intervals without an exam or going through the underwriting process. Such milestones include reaching a certain age or after the policy has been in force for a certain number of years. In other words, you can buy more life insurance without having to prove your insurability.

Such riders will also provide alternate dates to obtain additional insurance such as the date of marriage, the birth or adoption of a child when you need for insurance coverage may increase. That means you have the opportunity to secure extra coverage based solely on your age. The guaranteed insurability (gi) rider is available on certain life insurance policies and allows you to purchase additional insurance at specific dates in the future (subject to minimums and maximums) without having to go through an exam or answer health questions.

The insured is not required to present proof of insurability in order to acquire coverage. A l your insurance company wil take into consideration when increasing your premium is your age instead of your health. Many policies will also allow you to exercise your option up to 90 days in advance of a marriage or birth/adoption of a child.

When a policyholder decides to use the guaranteed insurability option, they have the right to purchase additional insurance at regular intervals. With a guaranteed insurability rider, you gain the option to increase the size of your coverage at set points in the future, such as every three or five years. This rider may provide specific market diversification for life events like weddings.

In order to obtain coverage, the insured does not need to provide proof of insurability. The guaranteed insurability (gi) rider is also called “additional purchase option.” this rider allows you to buy additional life insurance coverage (or death benefit) at specific intervals without an exam or going through the underwriting process. Increases do not require evidence of insurability and are based on the insured’s current income and.

The guaranteed insurability rider gives the insured the option to increase their base policy monthly benefit by purchasing additional amounts of insurance. A rider is an additional benefit to a life insurance policy beyond the death benefit. This rider allows you to increase your coverage at predetermined intervals—usually at certain ages, or after certain life events, like a marriage or the birth of a child—without purchasing a new policy or taking a new medical exam.

Insurers only allow benefit increases at specific times, known as option periods, which typically end around age 40—but option periods may also include major life events, such as marriage. This rider may give market diversification for specific life events like weddings or childbirth. This type of life insurance rider is considered an extra benefit that you can add to your policy for an additional cost when you purchase.

Typically, they do not need to provide the insurance company with any evidence of insurability up to a specified age, usually in the 40s. With a guaranteed insurability rider, you are a lowed to increase your insurance premium at certain intervals or ages. This rider guarantees that you can add more life insurance coverage at certain times, regardless of your health.

For example, if you buy a policy at the age of 25, you can choose to increase. The guaranteed insurability rider may be attached to a permanent life insurance policy and allows the owner to purchase additional life insurance at specified intervals in the future for specified amounts (subject to minimums and maximums) without the insured having to provide evidence of insurability. Guaranteed insurability rider intervals are typically three or five years.

Guaranteed insurability rider (gir) allows policyowner to purchase additional life insurance at specified intervals for certain amounts without having to provide evidence of insurability 25 and 40 at 3 year intervals Guaranteed insurability rider the guaranteed insurability rider allows you to increase the size of your death benefit to a predetermined amount at specific intervals. Additional amounts will have the same benefit period and elimination period as the policy.

Click to see full answer. Once you have a gi rider in place, you can increase your policy’s death benefit amount (if you want to) at specific points in the future, which are called option dates. Who should get a guaranteed insurability rider?

The typical guaranteed insurability rider lets you purchase insurance every three or five years on the anniversary date of your original policy. According to the new york department of financial services, this rider enables you to purchase additional coverage at specified intervals of time, up to a certain age (usually 40) without providing evidence of your insurability.

:max_bytes(150000):strip_icc()/Primarica_Recirc-805e6fc3e45b43f7839fe8847195ec95.jpg)

Guaranteed Insurability Rider What Is It

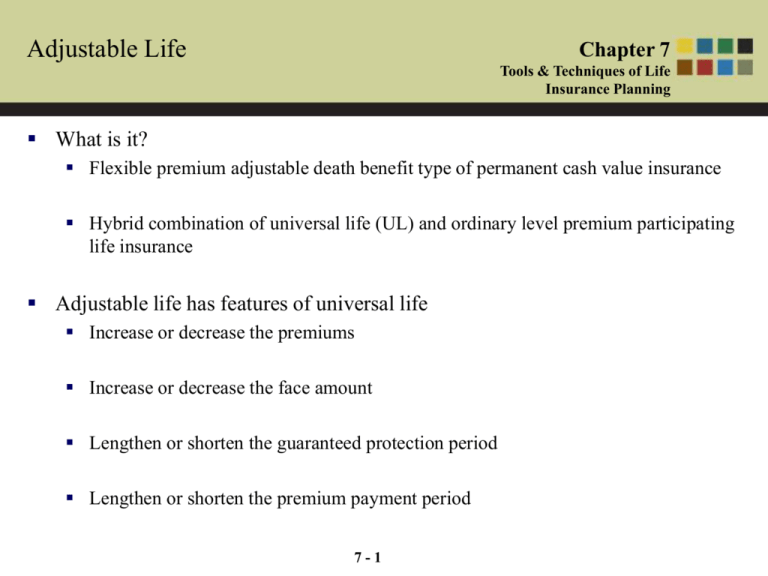

Chapter 7 Tools Techniques Of Life Insurance Planning 7

What Is A Guaranteed Insurability Rider - Cement Answers

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-491431690-e14b5f918f9c4ff2aadb75aec0e18a3f.jpg)

Guaranteed Insurability Rider What Is It

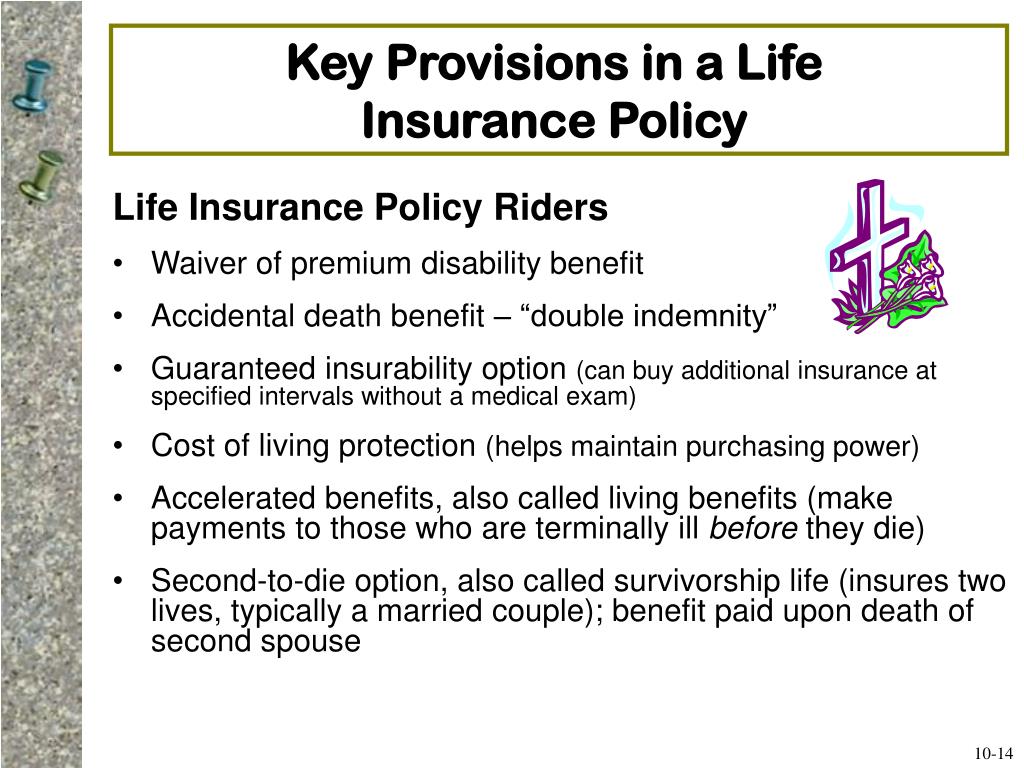

Ppt - 10 Financial Planning With Life Insurance Powerpoint Presentation - Id280077

Guaranteed Insurability Rider 3 Reasons You Should Consider It

What Is A Guaranteed Insurability Rider

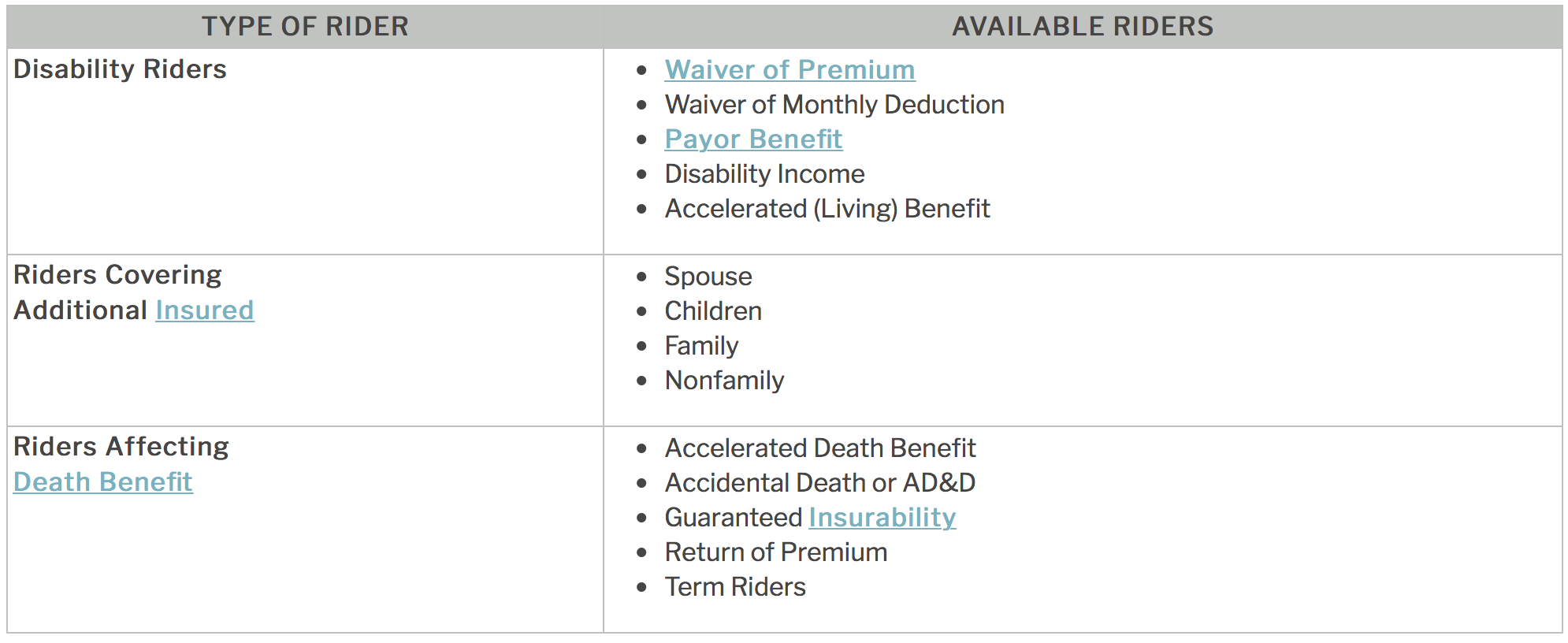

7 Life Insurance Riders To Consider

Policy Provisions Options And Other Features Flashcards Cheggcom

Chapter 5 Life Insurance Policy Options And Riders - Pdf Free Download

Guaranteed Insurability Rider - What Is It And How Can It Benefit You

7 Life Insurance Riders To Consider

Chapter 5 Life Insurance Policy Options And Riders - Pdf Free Download

:max_bytes(150000):strip_icc()/Foresters_Recirc-18f51e0437b54d0db40cdc1dd02aecaf.jpg)

Guaranteed Insurability Rider What Is It

:max_bytes(150000):strip_icc()/New_york_life_Recirc-79238f1ec6944ef785ff506d24bfe5c1.jpg)

Guaranteed Insurability Rider What Is It

Guaranteed Insurability Rider A Great Addition For Young Adults And Children

How Does The Guaranteed Insurability Rider Work The Insurance Pro Blog

Chapter 5 Life Insurance Policy Options And Riders - Pdf Free Download

Posting Komentar untuk "Guaranteed Insurability Rider Intervals"